Cars are technical masterpieces. Many as beautifully drawn and designed as pieces of art. Cars permit us to see friends and family, go to the most remote places. An enormous level of flexibility and freedom to go wherever we desire. Many of us love cars and many more depend on them. Ideally, they provide enough space for our belongings when going on vacation, carrying our mountain bikes or snowboards, and saving us money and hassle when moving our possessions between places. Cars are practical and offer a superbly comfortable and fun way to travel. But they have one drawback: car depreciation.

Amazing moments thanks to our car

I would never want to live without my car, as it gives me unlimited freedom. Mrs. Captain Finance and I have enjoyed the most memorable of moments. We have driven through the lavender fields in the south of France taking in the mesmerizing odors. We drove up some of the highest mountains in the Alps to enjoy beautiful ski slopes. We drove along beautiful coast lines to magnificent beaches and enjoyed picnics in the sunset – all thanks to the freedom our car gave us.

Our car is highly reliable. We never had a single issue in 8 years. But it would not be as much fun if our car was a squandering moving piggy bank with money pouring out left and right.

The truth is that most cars nowadays offer all those awesome benefits and are generally equipped with more technical and soothing features than most of us will ever use. What usually differentiates them is the price we have to pay. We have the choice between cars for under € 10,000 ($ 12,590/ £7,760) or € 1,000,000 ($ 1,259,000/ £776,000). But unless you are a sheik or hedge fund manager, your upper limit is likely to be below the 6- or 7-figure range.

Car depreciation

Regardless of the price, one thing all cars have in common is the depreciation of their value. With most cars offering similar features, it matters little what car you buy, but the magnitude of its depreciation. Wouldn’t we rather use the money saved from not buying a €/$/£ 100,000 car as a down payment for a property or invest it in another way to quickly reach the golden shores of financial freedom?

Depreciation varies between car makes, but overall they range from as low as 10% per year to 40%. As a whole the annual depreciation for new cars is 15-25%. Your newly bought car suffers the greatest depreciation in the first year and then the subsequent four years. As of Year 6, the annual depreciation becomes increasingly minor.*

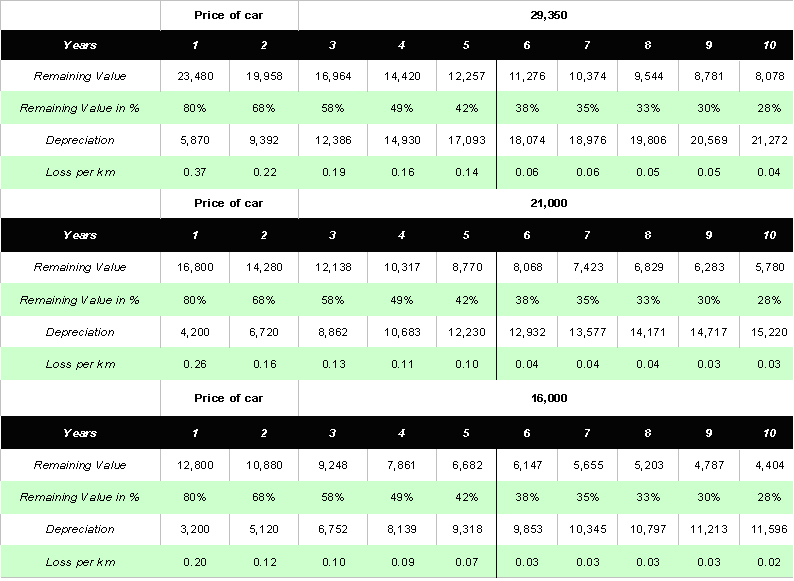

Let’s assume a three-stage depreciation process:

- 20% in the first year, as the loss is greatest the moment you leave the dealership

- 15 % every subsequent year until Year 5

- 8% every year after Year 5 when the depreciation process slows down

- Annual mileage 16,000 km (ca. 10,000 miles)

So how much would you lose each year?

The depreciation of your car's value, not considering costs for insurance, taxes, and other related factors are listed in the car depreciation table below:

Buy reasonable and keep for 5 years

As the above table shows, the longer we keep a car, the cheaper the cost per driven km or mile and the lower the annual loss. As you can see, the loss after Year 5 is relatively minor and stable. It is the first years; particularly, Year 1 and 2 that hit you the hardest financially and burn most of your car’s value. Buying a new car thus only makes sense when keeping it for more than five years. Anything less and you are throwing your money away.

When you are deciding on a new car, keep in mind that the highest losses are endured by those who opt for the more expensive car. The cheaper its initial price, the lower the depreciation in absolute numbers. Even if you are losing the same percentage of the car’s value year on year, you are saving a lot more money by buying reasonable and cheaper. Think about all the things you could do with the money you are saving by not seeing it vanish with your aging car.

A cheaper car will also give you greater financials returns over the years. Every penny that is not spent or lost is money that will speed up growing your wealth.

The pleasures of driving a new car

It would thus be better to buy a car with a few years on its clock, however if you are anything like me, you might opt for a brand new car. Firstly, you get the pleasure of being the first to drive the car, no surprises with regard to whether the previous owner took good care of it or how it was driven. Secondly, I am not a mechanic and am generally pretty clueless when it comes to cars. With today’s cars being rolling computers, their complexity leaves me stunned and by buying new I am minimizing risks and potential future repair costs.

But as we know, the longer we keep a car, the lower the depreciation. For that reason, I prefer to buy a new, reasonably priced car and keep it for as long as I can, as I am guaranteed a few years of technical support from both the dealer and the manufacturer. I am thus able to enjoy my car for many years, keep costs to a minimum, and with time, the car also becomes a pool of wonderful memories of all the trips and experiences I have enjoyed.

*

http://www.carsdirect.com/auto-loans/what-is-the-average-car-depreciation-rate

http://www.edmunds.com/car-buying/how-fast-does-my-new-car-lose-value-infographic.html

http://www.theaa.com/motoring_advice/car-buyers-guide/cbg_depreciation.html