Your car can make you significant amounts of money; and no, you don't need to drive for Uber to reap the financial benefits of your automobile. Truth be told, it is not the car per se, but the choice you make when buying your new car.

You may have read Money Squandering Cars or What We Have In Common With Warren Buffett. Both articles look at the financial loss when opting for an uber-prestigious car.

When I was looking for a new car, I opted for a non-luxurious make. As I was still in investment banking, I was surrounded by people driving Maseratis and Porsches. So a posh car would have been the way forward. But growing up my dad always told me that money should be wisely spent.

Buying a car, for most, is not an investment, but a leisurely activity and while it adds greatly to personal liberty, it has primarily one job to do: get you from A to B. As I love cars, I was indeed tempted by some of the luxurious brands out there. But once I started comparing what I would get for my money, I realized that I would not only be paying for the electronics and engineering, but also support the car manufacturer's marketing budget.

I thus chose the less prestigious car. It had the same features and in fact proved to be more reliable than its luxurious counterpart. Over the last 9 years I have never had a single problem. Even the widely available quality and reliability reports by the numerous car consultancies place my choice of car above many of its more expensive competitors.

But more than anything, it was the signficant financial difference: a massive € 8,000. Thousands of euros that could be used for so many other purposes.

Earning money from car depreciation

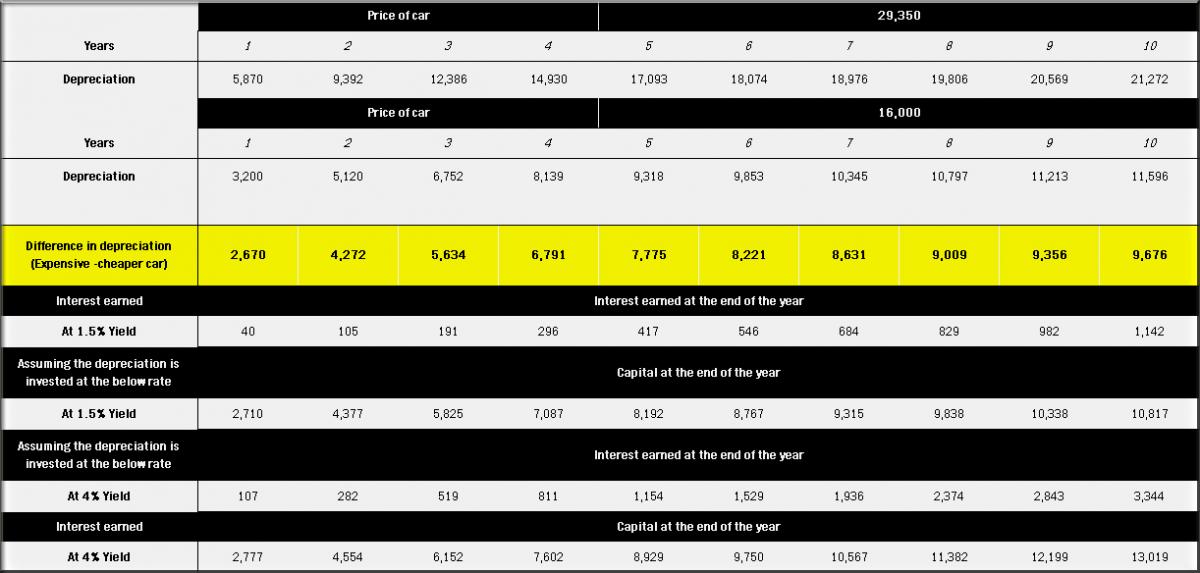

In Money Squandering Cars the expensive car lost a hefty $/€/£ 7,775 more in value after five years than the more affordable one. The owner of the cheaper car would be thousands of $/€/£ richer; merely due to the difference in car logo. Undoubtedly, luxury cars tend to have the newest technology, but whether one actually uses all their potential is debatable. Just ask yourself: “How much of the technological and electronic features and possibilities does my car have and how many of them have I ever used?” Regardless of what car you drive, most recent cars possess features that remain unused, and possibly even undiscovered by their drivers.

Now what would happen if the difference in depreciation between the prestigious and reasonable car had been invested at 1.5 or 4%?

Even at a meager 1.5% the difference in depreciation between the $/€/£ 29,350 and the $/€/£ 16,000 cars plus the interest earned had you invested the difference every year, would, after only 5 years, leave you $/€/£ 8,767 better off. After 10 years, opting for the cheaper car would make you $/€/£ 10,817 richer; without any effort. A simple choice between prestige and wealth will significantly increase your galleon of wealth. You do not have to work an additional hour, nor do you have to search for a good investment; such low interest can be achieved with a simple savings account.

Better still the picture if you invested that money in some average dividend paying blue chips or an ETF returning 4%, you’d be $/€/£ 8,929 better off after 5 years and a massive $/€/£ 13,019 after 10 years. The interest alone earned after six years is the median monthly salary in many countries.

Becoming wealthy with a non-luxurious car

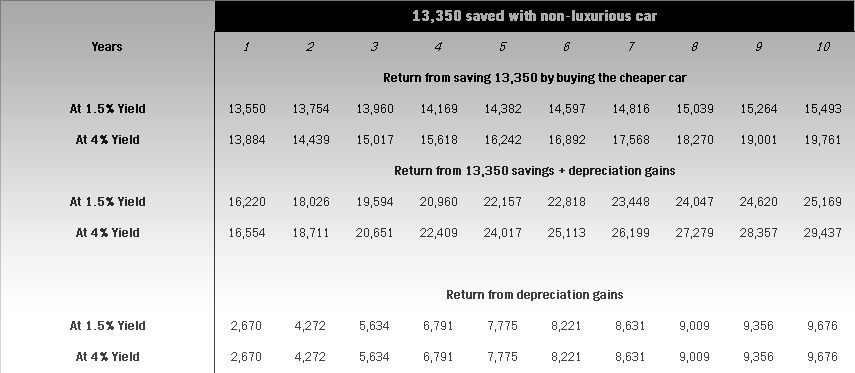

But opting for the cheaper car would have added $/€/£ 13,350 (29,350 versus 16,000) to your account from day 1. That is a lot of money that you can put to work. 13,350 crew members speeding up your galleon of wealth towards financial independence. The magic of compound interest, will grow your wealth even quicker.

Let’s assume you are

1) lazy and just put your money into a savings account at 1.5% and

2) do a bit of research and find stable dividend paying stocks at 4%:

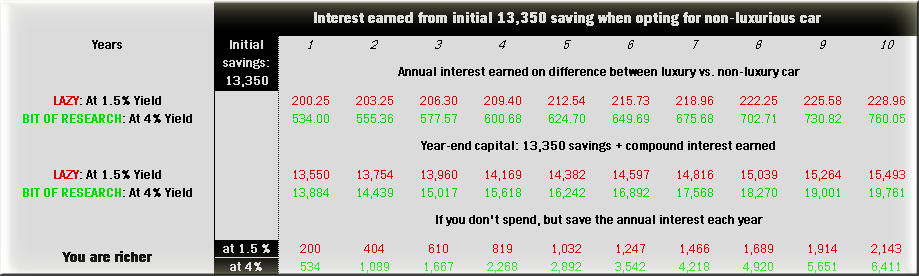

With the money saved from not buying the luxurious car, you - and that is if you feel lazy and just put the money into your savings account at 1.5 % - would be $/€/£ 1,032 better off after 5 years and $/€/£ 2,143.

If you do a bit of research and choose a company that is paying stable dividends of 4% per year, the $/€/£ 13,350 will earn you $/€/£ 534 in the first year alone and a massive $/€/£ 6,411 after ten years. That is the money earned in addition to being $/€/£ 13,350 richer from day 1.

The best part: you did not have to work for that extra income. All you did was to buy a slightly cheaper car.