I have a confession to make. I am an addict. I have been an addict all my life. It started at a very young age and I never managed to really control it. I know I am not alone. There are many who have that urge. If I have a bar in front of me, I will indulge. Most of it will be gone. Sometimes I can limit myself to just a few pieces or a spoon. If you are anything like me, you know the importance of sports, just to balance out its negatives. My addition: You put a jar of Nutella in front of me and, behold, I hold a spoon and munch away. I confess, I am addicted to chocolate.

For the love of chocolate

My love for chocolate earned me the title Biggest Chocoholic in the office some years ago. I couldn't go a day without it, I just love the stuff. If you're a chocoholic like me, you'll understand what I am about to tell you, if you're not a chocoholic you might think I am weird. But that's fine, as my love for chocolate is unbreakable.

I can get up in the morning and instead of a proper breakfast simply snack on a piece of chocolate. That will suffice. When I was a child my brother taught me, even though I doubt that he was aware, how to turn milk and Nesquik into not merely chocolate milk. Not the type of chocolate milk that you would usually drink. This one you'll almost have to eat – a tasty thick cream of partially liquid chocolate. Pour some chocolate powder into a cup, add a small amount of milk, just enough to cover the powder and there you have it: some tasty chocolate cream that you spoon out of the cup. Delicious.

Two of the greatest holidays are Easter and Christmas. For obvious reasons: chocolate.

Earning Money through chocolate

But here at Captain Finance we're more about finance and investing than chocolatey devouring. As Christmas is around the corner – dear, how time passes – I will find myself again indulging in some tasty chocolate Santa Clauses, bells, sledges, and devour the advent calendar. Isn't life just great?

Alright, enough about my indulgences. We are here to talk about making money. And chocolate, unless you eat it all up, can make you substantial amounts of money. If you are, like me, a lover of fine chocolates, the likes of Lindt will be up your alley. Sometimes, though, especially in the mornings, a nice cup of chocolate milk is just the right thing.

Sorry, going off track again.

How are fine chocolates and chocolate milk related to finance. More importantly, how can they earn you money?

Let's start with the latter: chocolate milk, as not only is it accessible to anyone from a retail price point – not that Lindt is that expensive, but there are much cheaper alternatives out there – but also from an investment point of view.

Imagine that with every cup you drink in the morning, the chocolate milk earns you money. Well, not directly, as you will have, most likely, paid for the chocolate powder, but indirectly, as in profits, earnings per shares, share price gains, and dividends.

The chocolate bunny that will earn you money

But what type of chocolate milk or powder can actually earn you money? Let's start with one of the most famous ones: Nestle. I love the smile of the little bunny in the morning. He's drawing you in with his gaze and you just need to pour yourself a cup of chocolate milk in the morning. Are the financials as appealing? *

It appears there are a lot of chocolate lovers out there. Nestle, for instance, has seen sales increase by almost 2 million Swiss Francs from 89.5 billion CHF in 2017 to 91.4 billion CHF in 2018. Their earnings per share have risen by over 1 Swiss Franc per share from 2.31 CHF to 3.36 CHF. Their profits have seen an even bigger increase. While profit after taxes stood at 7.5 billion CHF in 2017, Nestle managed, primarily through reducing their operating expenses, to bring in over 10.4 billion CHF in 2018.

Chocolate even pays during crises. Whilst many companies stopped paying dividends or at least reduced their dividends in the aftermath of the 2008 financial crisis, Nestle has steadily paid dividends since 1959. This is dividend aristocracy at its finest. (For those unfamiliar with the term, dividend aristocrats are companies that pay and continuously raise their dividends over at least 25 years). In 2018, Nestle paid a dividend of 2.45 CHF, a 3.07% dividend yield. Although the dividend has increased for most years since 1959, the dividend yield has been relatively stable over the years owed primarily to the steadily climbing share price.

Thus, if you had invested € 1,000 in Nestle in the last year, the dividend alone, € 30, could have bought you some boxes of their tasty chocolate powder. If you add the gains from Nestle's share price, oh dear, you'd also have to invest in new running shoes just to offset the consumed calories. You would look at a 20% gain.

Premium chocolate bunnies and a red suitcase

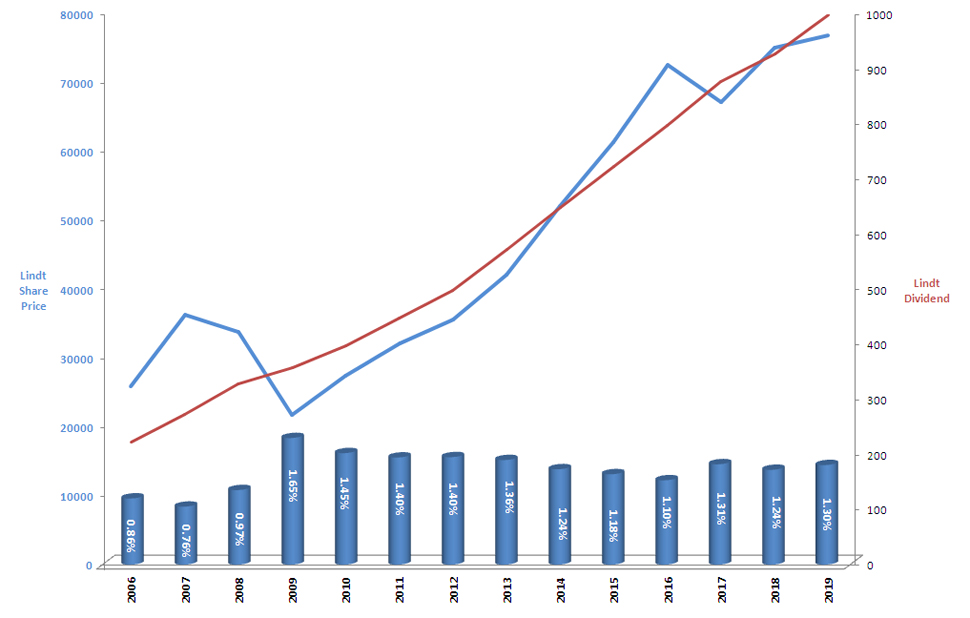

What if you are more into premium chocolates? Lindt, the maker of the golden Easter bunnies and Christmas bells, might be your go-to chocolate investment. If you buy their Registered Shares, you will not only get voting rights with your shares, but also a 5 kg box of chocolate at Lindt's annual general meeting. The only drawback, Lindt shares are, similar to their chocolates, indeed premium. One share currently trades around 80,000 CHF. In Euros that is almost 73,000, in Sterling almost 63,000, and in US Dollars 81,000. In some areas that could almost buy you a small apartment. Then again, you will get 5 kg of tasty Lindt chocolate if you attend their annual general meeting or ask them to ship it to you.

Lindt has also increased their dividends year-on-year. The last dividend was a full 1,000 CHF. The premium price tag of 77,100 CHF, however, only yielded 1.3% in dividends. Nothing to shout about, but still more than most savings accounts. Their share price has not fared as well as Nestle's, remaining relatively stable over the last twelve months with a gain of just over 5.8 %.

If you are still keen on investing in Lindt, but are looking for something with a smaller price tag, their Participation Certificates might be interesting. Currently trading around 7,000 CHF, they come with a similar dividend yield, but will leave you without the pleasure of voting at the annual general meeting, and maybe more importantly, when talking about chocolate, the priced 5 kg chocolate box.

Chocolate investments can make you rich

You see, loving chocolate can indeed be enriching. To me there is little question that my next investment, when prices drop slightly, I shall put some money to work in chocolate. Whilst I find the Lindt 5 kg box very appealing, I will probably opt for a higher dividend yielding stock with a price tag that is less premium, but makes my mornings bunny-awesome.

* Of course Nestle has many more products than just chocolate.

** Disclaimer: This is no financial advice. If you invest in any of these shares, this is at your own risk. I am no financial advisor, nor do I currently hold shares in either Nestle or Lindt.